It’s been a few months since our last bankruptcy trends update. In that time (usually one of the busiest for bankruptcies,) we’ve seen federal unemployment assistance end, national stimulus talks stall, an election, and Coronavirus spikes across the country. So, the question is - what impact has this had on the bankruptcy industry?

To help all of us tackle this question, we’ve, once again, compiled data from LeadQ bankruptcy inquiry campaigns, Google analytics and trends, and EPIQ/AACER Court Data to get a big picture view of the current situation. And, hopefully, be able to predict what might come next.

Let’s break down four key statistics and their impact - Google searches, Chapter 7 filings, LeadQ campaign impressions, and qualified inquiries. We also have a new section in this blog about the top 10 states to watch over the next few months.

NATIONAL BANKRUPTCY TREND DATA

It’s impossible to use one data source to get an idea of national bankruptcy trends. This is particularly true because of the varied time it takes a consumer to go from researching bankruptcy options to hiring an attorney to filing. That’s why we look at both leading data - Google searches - and trailing data - Chapter 7 filings.

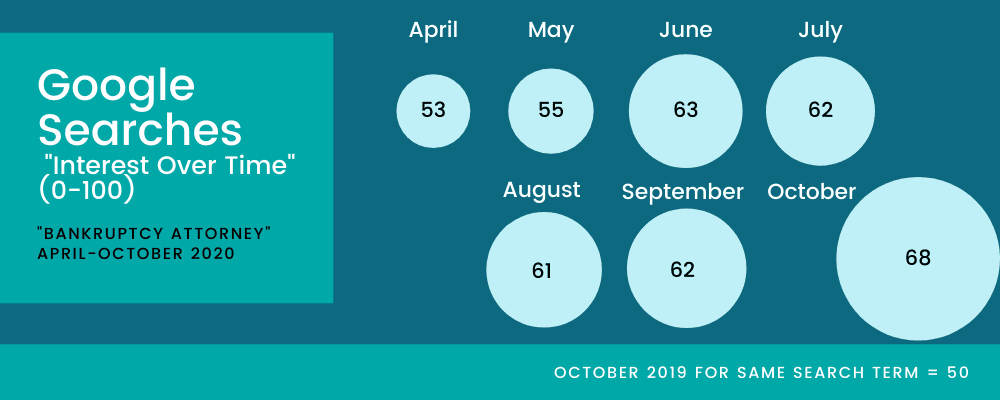

Google does not release exact search data, but its search trends tool rates the popularity of search terms over time. It’s an invaluable tool for checking trends and behavior across Google Search, Google News, Google Images, Google Shopping, and YouTube.

Searches are rated in popularity from 0-100 with 100 being peak popularity and 0 meaning there is not enough data to even rank the term. There is no direct conversion rate for volume, but search popularity is an excellent indicator of the national mindset on a topic.

Search volume stayed fairly static over the Summer which was to be expected. It’s generally a slower time of year for bankruptcy, unemployment assistance was still in place (or only just ending,) and stimulus talks seemed to be in full swing. The big jump from 62 - 68 from September to October is indicative of a change in mindset and needs for the months ahead.

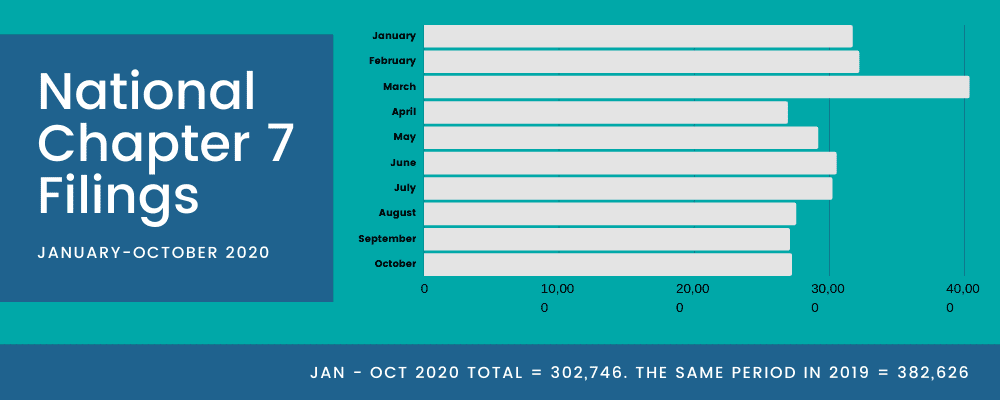

Unsurprisingly, we see a similar trend over the Summer months with our trailing data in the form of Chapter 7 filings. These people likely researched and then hired an attorney 1-3 months before filing. Therefore, September/October filings are as a result of initial interest from approximately June/July.

What will be particularly interesting to see, as filing numbers come in for the last few months of the year, is whether the significant search trend jump for September can be seen in filings before the end of 2020.

LEADQ BANKRUPTCY TREND DATA

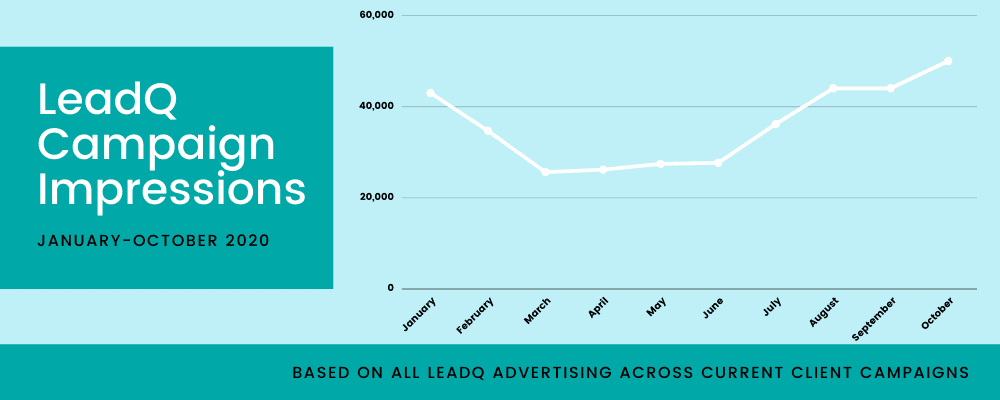

With clients and active bankruptcy marketing campaigns running all across the country, LeadQ has unique access to real-time data. By connecting key information from campaigns in multiple states, we map trends from coast to coast to get an immediate snapshot of how many people are searching for bankruptcy attorneys in any given month.

LeadQ advertising is designed to capture potential clients when they are ready to retain an attorney - as opposed to just beginning to research options with the broader search terms we see in Google Trends data. This more focused look uses our business data to show true trends from month to month.

We can clearly see the steep drop from March through June and then a steady increase over late Summer and Fall. A boost in the Fall is to be expected for a “standard year” and is heartening to still see in such an unusual year as 2020.

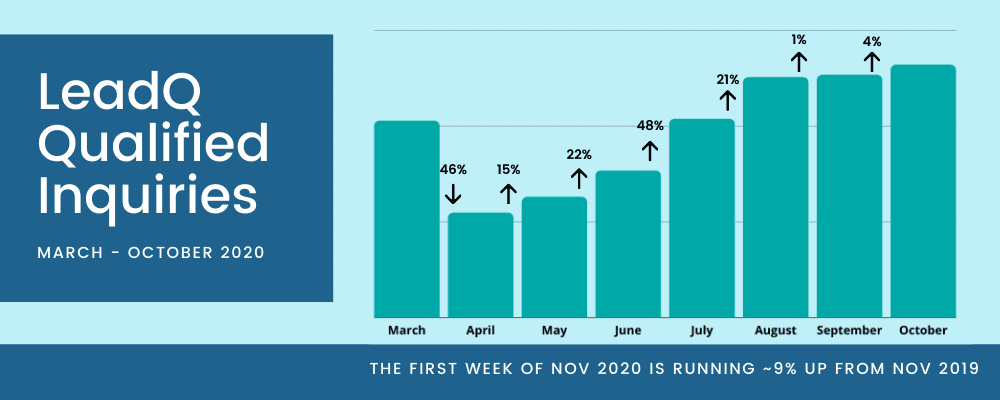

Following impressions, the next logical step is to track conversions to qualified bankruptcy inquiries - ie potential clients. The below Qualified Inquiries chart tells a similar story to the impressions chart above. After a steep drop from March, we saw a low Summer and then a steady climb over the past few months. It’s good to see that those searching are indeed converting and taking the step to reach out to local attorneys.

To clarify, this chart shows distilled numbers from all calls and emails to LeadQ clients into only those determined qualified for bankruptcy.

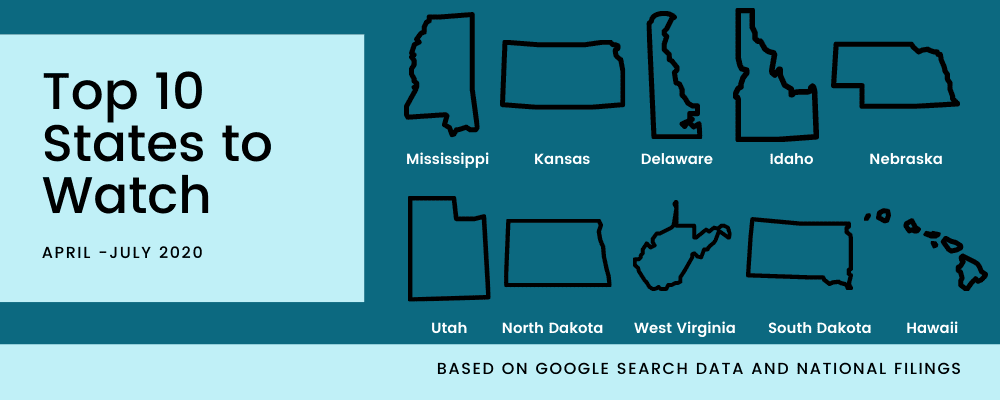

TOP 10 STATES TO WATCH

Have you seen similar trends at your practice over the past few months? Are the Fall months showing steady increases? If your business state is in this graphic your boom may be on its way. These states have either higher bankruptcy search trend numbers than the national average or rank in the top 10 for states with greatest per capita Chapter 7 filings - or both.

WHAT COMES NEXT?

The holiday season is notoriously slower for bankruptcy attorneys, and we anticipate this year to be similar. So, let’s focus on the beginning of 2021. Just this week, newyorkfed.org reported a record $10 trillion in mortgage debt after Q3 2020. We see a big surge of bankruptcies coming in the first few months of the year, and we’re not the only ones. In September, Forbes quoted the co-founder of NACBA as saying:

“All of us in the field are expecting bankruptcies to spike up dramatically, probably later this year and even more so into the New Year as the longer-lasting effects of the pandemic hit people in the wallet,” Ike Shulman, bankruptcy lawyer and co-founder of the National Association of Consumer Bankruptcy Attorneys (NACBA)

Researcher Deb Gordon at moneygeek.com predicts, “A surge of personal and commercial bankruptcies seems inevitable in the wake of the coronavirus, but it hasn’t hit yet.” The Washington Post interviewed six experts for an October 27th, 2020 bankruptcy piece, “including law professors, academic researchers, consumer advocates and other bankruptcy attorneys, [all] agree that a wave of personal bankruptcies is unavoidable.”

So, what does that mean for you? It means that now is the time to get prepared. Make sure your administration and procedures are organized and effective, set up online and phone consultation options if you haven’t already, and most importantly, start building a marketing plan now. When this inevitability hits, you want to make sure that you are set up to help as many people and retain as many clients as possible.

LeadQ is here to help make sure your marketing is in place for 2021. Their campaigns have been adapted specifically for the current COVID-19 environment and are proving successful encouraging people to take care of their troubles sooner rather than later. If you want to find out more about their programs and check availability in your area, fill out the form below.

**************************************************************************************

LeadQ is a leader in new client acquisition programs for bankruptcy attorneys. With their unique performance-based approach, clients pay only for the “qualified” bankruptcy Inquiries generated. LeadQ has, for the last 12 years, been successfully helping attorneys across the country grow their firms. To learn more, fill out the contact form below and a representative will reach out to you.